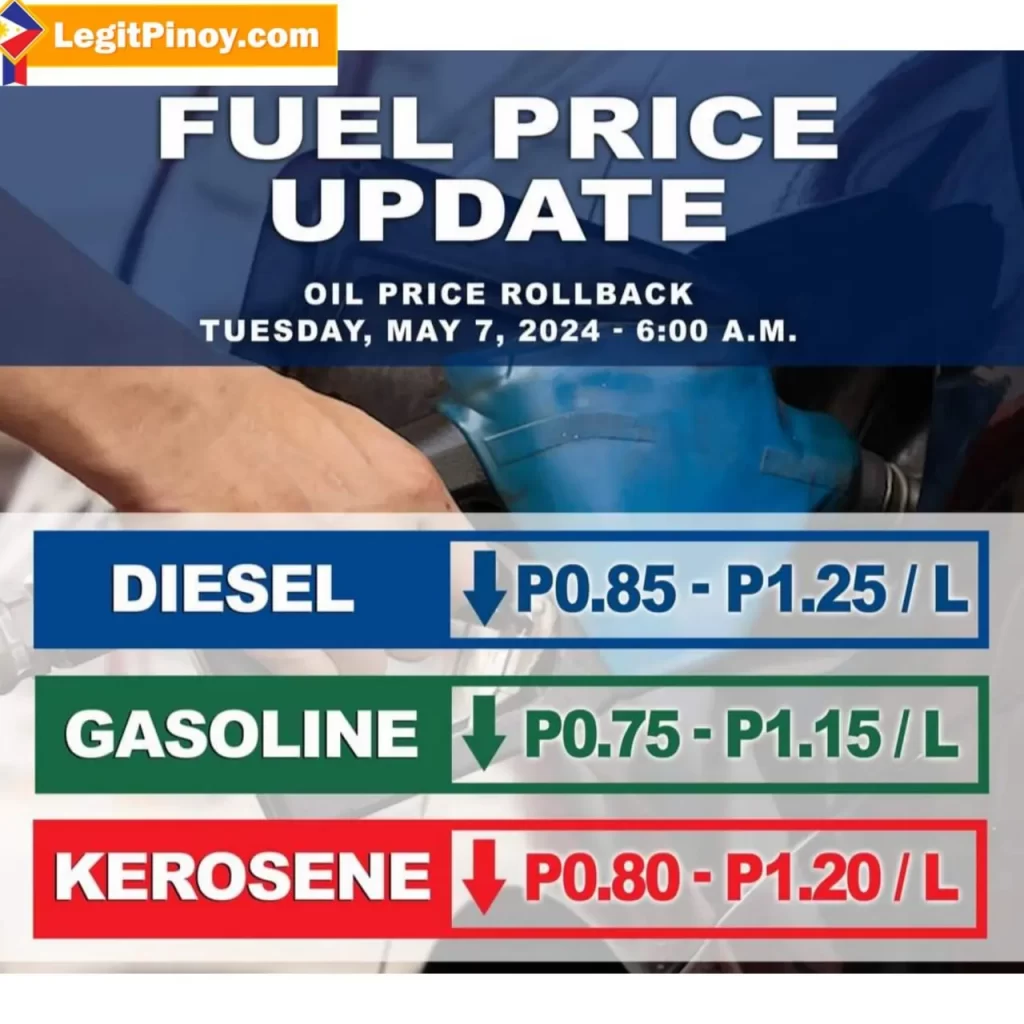

“Oil Price Rollbacks: Global Impacts Unpacked May 7, 2024”

Oil price rollbacks: Explore the effects on global economies. Discover implications for industries, consumers, and policymakers in this insightful analysis.

Advertisement

Introduction

Recently, the global economy has witnessed significant fluctuations in oil prices, often characterized by sudden rollbacks. These fluctuations, commonly referred to as oil price rollbacks, have far-reaching implications across various sectors of the economy, impacting businesses, consumers, and policymakers alike.

Understanding the drivers behind these rollbacks and their effects is crucial for navigating the complex landscape of global markets. In this essay, we will delve into the intricacies of oil price rollbacks, exploring the factors contributing to their occurrence and examining their implications for economies worldwide. By unpacking the dynamics of oil price rollbacks, we aim to shed light on their significance and provide insights for informed decision-making in an ever-changing economic environment.

Causes of Oil Price Rollbacks

- Oversupply in the Market:

- Increased production by oil-producing countries: Oil-producing nations, particularly those within OPEC (Organization of the Petroleum Exporting Countries), may ramp up production levels to gain market share or maintain their geopolitical influence. This can lead to an oversupply of oil in the global market, causing prices to decrease due to the abundance of supply.

- Expansion of non-traditional oil sources (e.g., shale oil): Technological advances, such as hydraulic fracturing (fracking), have unlocked vast reserves of previously inaccessible oil, particularly in regions like the United States. The proliferation of shale oil production has significantly increased global oil supplies, contributing to downward pressure on prices.

- Decline in Demand:

- Economic slowdown or recession: During an economic downturn or recession, oil demand declines as businesses reduce production and consumers cut back on discretionary spending. Reduced economic activity leads to lower demand for energy, including oil, resulting in a surplus of supply relative to the market and subsequent price rollbacks.

- Shift toward renewable energy sources: The growing awareness of environmental concerns and the push for sustainable energy alternatives have fueled a shift away from fossil fuels and toward renewable energy sources such as solar, wind, and hydroelectric power. As countries and industries invest more in renewable energy infrastructure and technologies, oil demand may decrease, impacting prices.

- Geopolitical Factors:

- Resolution of conflicts in oil-producing regions: Geopolitical tensions and conflicts in key oil-producing regions, such as the Middle East, Africa, and South America, often disrupt oil production and supply chains, leading to price volatility. Conversely, resolving conflicts or easing geopolitical tensions may stabilize oil markets and contribute to price rollbacks as supply concerns diminish.

- Changes in political leadership or policies affecting oil production: Political decisions, such as changes in government leadership or shifts in energy policies, can significantly impact oil production and export strategies. Policy changes related to taxation, regulation, or environmental protection measures may influence oil market dynamics and contribute to price fluctuations.

Consequences of Oil Price Rollbacks

Economic Effects:

- Lower fuel costs provide relief for consumers and businesses. Oil price rollbacks typically lead to lower fuel prices at the pump, providing financial relief for consumers and reducing operational costs for industries reliant on transportation. This extra disposable income can stimulate spending in other sectors of the economy, contributing to economic growth.

- Impact on oil-dependent economies and industries: Lower oil prices may benefit consumers and some industries, but they can adversely affect economies heavily reliant on oil production and export. Oil-dependent countries may experience revenue losses, budget deficits, and job layoffs, leading to economic instability and social unrest in extreme cases.

Market Volatility:

- Fluctuations in stock markets and commodity prices: Oil price rollbacks can trigger volatility in financial markets, particularly in sectors related to energy production, transportation, and commodities trading. Oil companies and related industries’ stock prices may fluctuate in response to changing oil prices, impacting investor confidence and market sentiment.

- Uncertainty for investors and financial markets: The unpredictability of oil price movements can create uncertainty for investors and financial markets, making it challenging to make informed investment decisions. Investors may adopt a cautious approach or adjust their portfolios in response to fluctuating oil prices, amplifying market volatility.

Environmental Implications:

- Potential slowdown in renewable energy adoption: Lower oil prices may disincentivize investment in renewable energy technologies and infrastructure as fossil fuels become more competitive in the short term. This could delay the transition to cleaner energy sources and hinder progress towards sustainable development goals.

- Effects on climate change mitigation efforts: Reduced investment in renewable energy and increased reliance on fossil fuels due to lower oil prices can have negative implications for climate change mitigation efforts. Higher carbon emissions from increased fossil fuel consumption may exacerbate global warming and environmental degradation, undermining international efforts to combat climate change.

Advertisement

Responses to Oil Price Rollbacks

A. Policy Interventions:

- Government subsidies or stimulus packages for affected industries: Governments may provide financial assistance, subsidies, or tax breaks to industries adversely affected by oil price rollbacks, such as transportation, manufacturing, and agriculture. These measures aim to alleviate financial strain, preserve jobs, and stimulate economic activity during economic uncertainty.

- Strategic reserves and emergency measures to stabilize prices: Governments may deploy strategic petroleum reserves or implement emergency measures to stabilize oil prices during periods of extreme volatility. These actions can involve coordinated efforts with other oil-producing nations or international organizations to manage supply and demand dynamics and prevent excessive price fluctuations.

B. Business Strategies:

- Adaptation and diversification of energy sources: Businesses may explore alternative energy sources and diversify their energy portfolios to mitigate the impact of oil price rollbacks. This could involve investing in renewable energy technologies, improving energy efficiency, and reducing dependence on fossil fuels to enhance resilience against future oil price fluctuations.

- Cost-cutting measures and efficiency improvements: In response to lower oil prices, businesses may implement cost-cutting measures and efficiency improvements to optimize operations and reduce expenses. This could include streamlining production processes, renegotiating contracts with suppliers, and reducing overhead costs to maintain profitability in a challenging economic environment.

C. Global Cooperation:

- Diplomatic efforts to address oversupply and stabilize oil markets: International cooperation and diplomatic negotiations play a crucial role in addressing oversupply and stabilizing oil markets. Oil-producing nations may engage in dialogue and collaboration to coordinate production levels, manage inventory, and regulate exports to prevent price collapses and maintain market stability.

- Collaboration on sustainable energy solutions and climate goals: Given oil price rollbacks and the broader challenges climate change poses, global cooperation on sustainable energy solutions is essential. Countries may collaborate on renewable energy projects, share best practices, and commit to climate goals outlined in international agreements such as the Paris Agreement, fostering a transition towards cleaner and more resilient energy systems.

People’s reactions to oil price rollbacks

- Consumers:

- Positive Reaction: Consumers generally welcome oil price rollbacks as they result in lower fuel costs, leading to savings on transportation expenses and household heating bills. This extra disposable income can be redirected towards other goods and services, boosting consumer spending and economic growth.

- Adverse Reaction: Some consumers may express concerns about the broader economic implications of oil price rollbacks, particularly if they indicate broader economic downturns. They may worry about job security and the overall economy’s health, especially if lower oil prices are accompanied by layoffs or reduced economic activity in oil-dependent regions.

- Businesses:

- Positive Reaction: Businesses that rely heavily on energy-intensive operations, such as transportation, manufacturing, and agriculture, generally benefit from lower oil prices. Reduced fuel costs can lead to lower production expenses, increased profitability, and enhanced market competitiveness.

- Adverse Reaction: Conversely, businesses operating in the oil and gas sector may experience financial strain and reduced profitability during oil price rollbacks. Companies involved in exploration, drilling, and oilfield services may face challenges as demand for their products and services declines.

- Investors:

- Positive Reaction: Investors in sectors that benefit from lower oil prices, such as transportation, airlines, and consumer goods, may see increases in stock prices and dividends. Lower fuel costs can improve profit margins for companies in these industries, driving investor confidence and attracting capital.

- Adverse Reaction: Oil-related industry investors may experience stock price declines and investment returns during oil price rollbacks. Energy companies, particularly those with high production costs or significant debt burdens, may face financial difficulties and struggle to maintain shareholder value.

- Governments:

- Positive Reaction: Governments of oil-importing countries generally view oil price rollbacks favorably as they reduce import costs and inflationary pressures. Lower oil prices can stimulate economic growth and consumer spending, increase tax revenues, and improve fiscal conditions.

- Adverse Reaction: However, governments of oil-exporting countries may experience revenue losses and budget deficits during oil price rollbacks. These countries heavily rely on oil revenues to fund public services and infrastructure projects, and lower oil prices can constrain their ability to meet budgetary obligations.

Advertisement

Conclusion

In conclusion, exploring oil price rollbacks illuminates the intricate web of factors influencing global energy markets. Oil prices ‘ volatility underscores the need for proactive responses, from the oversupply resulting from increased production to geopolitical tensions and economic shifts. Given the dynamic nature of oil markets, stakeholders must remain adaptable and forward-thinking in their strategies.

This calls for collaborative efforts across governments, businesses, and international organizations to navigate the uncertainties and promote economic stability. Moreover, amidst the challenges posed by oil price rollbacks, there’s a clear imperative to accelerate the transition toward sustainable energy sources. By embracing innovation and fostering international cooperation, stakeholders can mitigate the impacts of oil market volatility and contribute to a more resilient and sustainable future.

An article might also be like

- actress-maricel-soriano

- spinx777-casino

- 55jl-casino

- jiligo88-bet

- one-piece-ep-1102

- west-philippine-sea

- pera57-casino-online

- charles-leclerc

- miss-universe-philippines

Josephine Gomez is an expert in the casino industry. She specializes in VIP programs, gaming strategies, and casino operations. Josephine profoundly understands what makes a casino experience exceptional and is dedicated to sharing her knowledge to help players maximize their enjoyment and rewards. Her insights are trusted by many in the gaming community.